Ms X should write off Rs. D paid the 800 amount that the company had previously written off.

Bad Debt Overview Example Bad Debt Expense Journal Entries

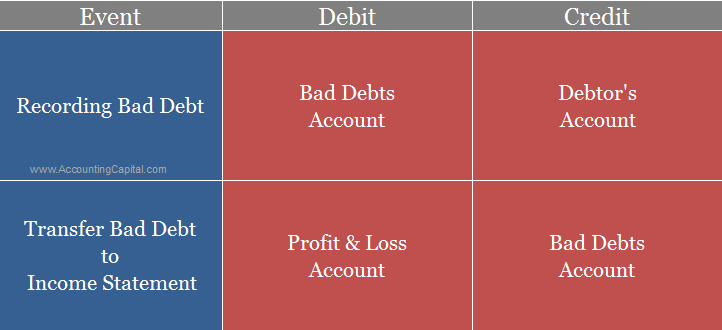

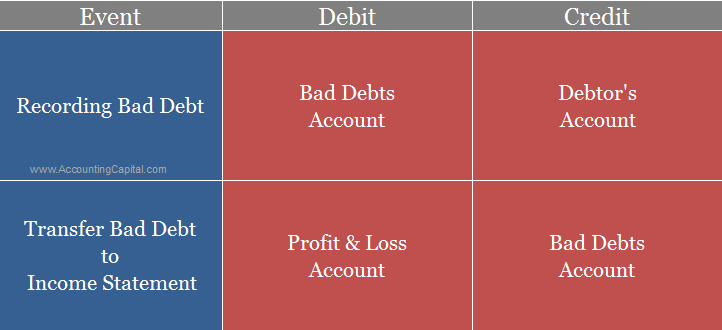

Bad debts has to be debited as an expenseloss and credited to sundry debtors account.

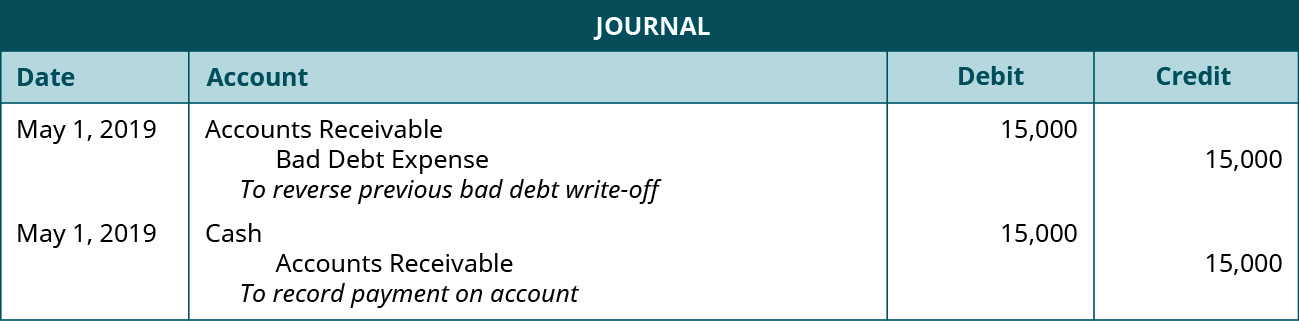

. We use the allowance method to deal with bad debt so the net book value of their accounts on the balance sheet is already zero. When a written off account is recovered the first step is to reinstate it in the accounting record. When the amount that is earlier written as bad debts is now recovered it is called bad debts recovered.

Note that the provision for bad debts on 31122017 is Rs. The journal entry of the above entry will be. Already has 7000 in the provision for doubtful debt accounts from.

Bad debts Ac Dr. The following journal entry is made for this purpose. However on June 12 2021 Mr.

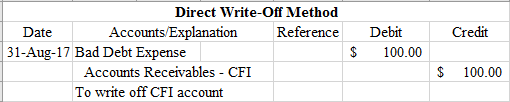

A bad debt can be written off using either the direct write off method or the provision method. When an account receivable is. A sum of 2000 earlier written as bad debts is.

Notice that this entry. 1000 from Ms KBC as bad debts. Being cash received from Mahesh and bad debts written Bad is loss and.

Journal Entry for Bad Debts Written Off Written off means we are closing bad debt account by transferring bad debt amount to the debit side of our profit and loss account. Lets say youve been in business for a year and that of the total 300000 in credit sales you made in your first. Bad debts is a loss for the organization and should be debited to profit loss.

The journal entries you will need to make depends on whether a general or specific provision needs to be created or whether a debt balance needs to be fully or partially written. In this case we can make the journal entry for this 50000. Bad Debts Ac Dr.

Please provide the journal entries to be made for bad debt. After the journal entry is made Sales still records. The dealer records the accounts as bad debts after using collection support and yet is.

A car dealer finds out that three of the clients have not repaid their car loans. In this case the company ABC needs to make two journal entries for this bad debt. Since the tax is payable regardless of collection status the debt is written off with the following journal entry.

As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10. The first approach tends to delay recognition of the bad debt. Percentage of bad debt Total bad debts Total credit sales.

The exact journal entries that need to be passed however depend on how the write-off of the receivable was recorded in the first place. Note the absence of tax codes. August 21 2022.

What Is The Journal Entry For Bad Debts Accounting Capital

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Writing Off An Account Under The Allowance Method Accountingcoach

3 3 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting

0 Comments